3 keys that unlock data-driven fundraising

For founders and startup teams looking to become more data-driven in their approach to fundraising, the following steps are a good place to start.

For companies raising capital in the coming year, news of rising interest rates, market volatility and falling valuations paints a daunting picture.

Understandably, founders are eager to understand how current public market conditions may impact fundraising in the private markets. The good news is, in the context of history, periods of market correction are common –– and great companies are still poised to thrive.

In more favorable market conditions, using performance data to articulate a clear story about your company’s potential is a best practice. But in the current volatile environment, using data to tell your story is imperative. Whether looking to raise equity or debt, investors pay even closer attention to a company’s performance and projections in order to manage their own investment risk.

Good news: in the context of history, periods of market correction are common, and great companies are still poised to thrive.

As a former venture capitalist, I tell all founders that confidence in their data will have major implications on their company’s valuation and deal terms when raising capital.

Unfortunately, many companies lack an efficient way to gather, synthesize and interpret data into real-time insights, resulting in the default reliance on static, Excel-based samplings that may not capture the full picture of your company’s potential.

With all this friction, it can be challenging for entrepreneurs to even know where to begin. For founders and startup teams looking to become more data-driven in their approach to fundraising, the following steps are a good place to start.

Start with revenue cohort analysis

A cohort analysis looks at different groups of customers, whether that be users over certain periods of time or segmented by region or size, and allows investors to see how they individually perform. Investors love to see into the future because they know that the value of a business is the present value of its future cash flows.

By decomposing the drivers of revenue growth via cohort analysis, you can raise investors’ confidence in your cash flow projections, resulting in a higher valuation or more favorable loan terms.

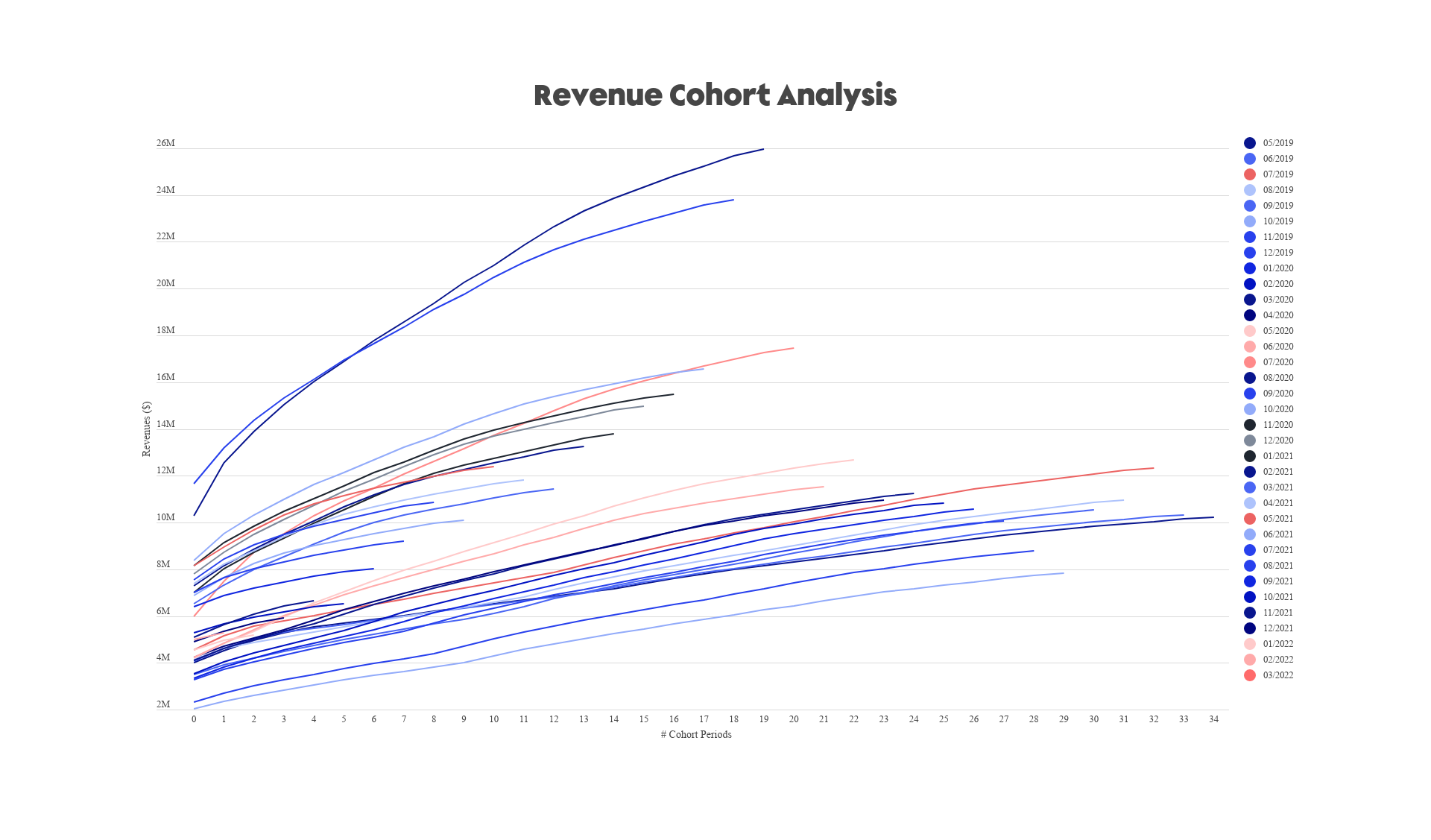

Revenue cohort analysis, May 2019 to March 2022. Image Credits: Hum Capital

Take the above graph as an example. The cohort analysis shows that newer groups of customers are larger and more retentive than ever before. This indicates to investors that there is a trend toward higher customer lifetime value, which ultimately instills confidence in your company’s future growth.

Companies that can tie the same cohort performance to improving sales and marketing efficiency will help demonstrate that the business’ growth is not just a function of increased spending on customer acquisition and retention. In other words, this is a company that is compounding value and thus even more valuable to investors.