Alan offers its insurance stack to smaller health insurance companies

French startup Alan currently insures more than 200,000 people with its own health insurance contracts. The company is expanding its business in two different ways — it wants to offer more services to turn its insurance app into a health superapp, and it is announcing today that it wants to sell its infrastructure and tech […]

French startup Alan currently insures more than 200,000 people with its own health insurance contracts. The company is expanding its business in two different ways — it wants to offer more services to turn its insurance app into a health superapp, and it is announcing today that it wants to sell its infrastructure and tech stack to other insurance companies.

With this new activity called Alan-as-a-service, Alan essentially provides all the services that you need to run a health insurance in France — except that other insurance companies are creating those insurance products.

The best way to describe how it works is by talking about the first Alan-as-a-service customer. Lamie mutuelle is partnering with Alan and is going to use Alan’s services going forward.

It is a health insurance company covering 85,000 people, which means that it doesn’t have a big in-house engineering team. After the switch to Alan-as-a-service, existing Lamie customers don’t have to sign a new contract. Lamie is still in charge of pricing its insurance products and selling them to companies and individuals.

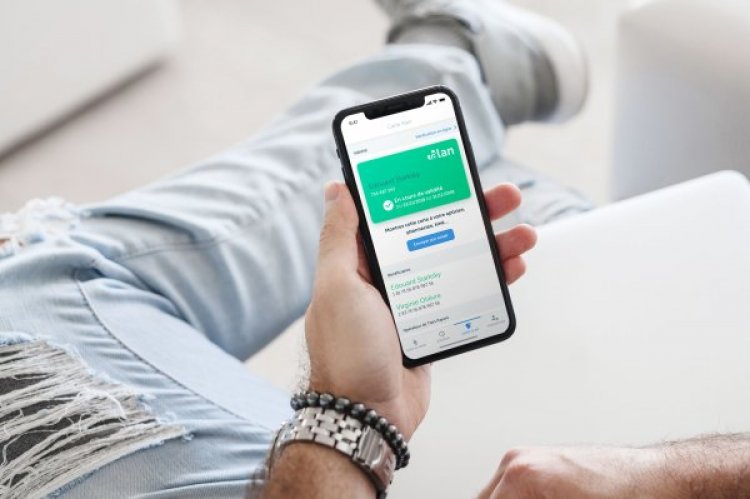

“They use our mobile app. It’s the main Alan mobile app, it’s the one that is available in the App Store. The only difference is a Lamie splash screen that their members will see,” co-founder and CEO Jean-Charles Samuelian-Werve told me.

When you pay at the doctor’s office, Alan is in charge of comparing what you paid with the coverage you get from your Lamie contract. And Lamie members should notice a real improvement as Alan has refined this process quite drastically.

In France, private heath insurances are connected to the national healthcare system card. When you hand your card to the doctor, Alan is notified of a payment in just a few seconds. That’s why Alan has automated this process as much as possible. In most cases (two thirds), members receive reimbursements on their bank account in less than an hour. The national healthcare system pays a portion as well, but it usually arrives a few days later.

Companies who signed up with Lamie for a health insurance contract will also be able to access the Alan backend website to manage employees, invite them to create an account or remove them when they leave the company.

The three stakeholders are gaining different things from Alan-as-a-service. People who have a Lamie insurance product will gain a better user experience and access to other Alan services. Lamie has relegated IT issues to Alan. And Alan gains 85,000 users overnight.

Alan might not generate the same margins from third-party members compared to its own members. But that should definitely help when it comes to growth in the health insurance market, which remains highly fragmented.