Circa wants to make first-of-the-month rent payments obsolete

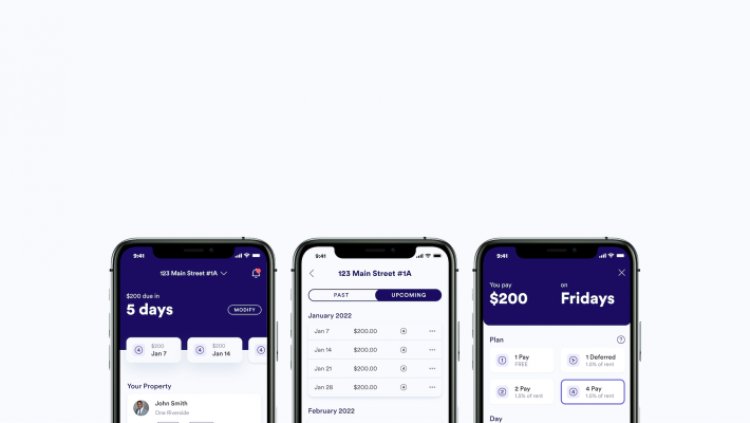

Renters can choose their payment method, split up payments and schedule the payments, all while having flexibility should income become a problem.

Paying rent on time can mean the difference between having a place to live, and well, not. Circa believes there is a simpler way to help renters keep a roof over their heads.

The Maine-based payment technology company has created a mobile-first platform to enable renters to pay on time, in full, each month. And, if you run into problems and can’t pay the entire rent, Circa provides the option to break up the payments.

Co-founder and CEO Leslie Hyman told TechCrunch that over $15 billion in rent is paid late every month in the United States. Not only does that hurt their credit and their housing situation, but it also challenges the relationship between the renter and the property owner.

She shared some interesting stats, including that about 30% of rent payments come in later that the fifth of the month, and that 5.9 million renters, or 15%, were behind in payments, accounting for something like $41 billion in arrears monthly in the U.S. On the property owner side, evictions can cost them between $3,500 and $10,000, and they often have only an average success rate of 17% on debt collection.

Hyman’s background is in life insurance, and she had previously worked for large entities like AIG and MelLife, helping them build new businesses based on payments. She explained that when insurance premiums would bill at the beginning of the month, some 20% of them would not go through and need to be rebilled. When they started listening to the customer support calls that came through, many customers would be asking for a different date, when funds would be available.

That’s when she and her co-founder, Heman Duraiswamy, who has a background in residential real estate ownership, took a look at the pain of paying bills and started Circa in 2019. Circa completed the Techstars accelerator program at the Roux Institute in Portland, Maine in 2021.

“We started to understand what’s happening in America where if you look at the critical bills of housing, transportation and health, those all have the beginning of the month, and they add up to on average over $2,600,” Hyman said. “With income volatility increasing 40% in the past 50 years, you begin to question why we bill on the first of the month.”

Circa CEO Leslie Hyman. Image Credits: Circa

Circa’s aim is to get out ahead of late rent, and in turn, foster a better relationship between property owner and renter. It is working with 1,000 units under management in the Northeast, Pennsylvania and in Sun Valley.

It raised $2 million — with another bit of money coming in soon — to expand the kinds of properties it can work with. Investors in the round include Maine Venture Fund, Techstars and Hub Investment Group.

Its sweet spot is properties with between 1,000 and 10,000 units. The app and web platform integrate with the property owner’s current property management software. Circa will promote to residents that it is there.

Renters set up an account in minutes and can choose their payment method and schedule the payment — a feature that can be changed anytime if money is tight. There is an option to pay in full or split up the payments and have money pulled on different weeks. Circa sends notifications letting the renter know the payment is coming out of their account, and there is the ability to make a last-minute change.

Circa makes money in a few ways: The company charges the property owner $1 per unit per month in a SaaS fee. Hyman explained that the owner actually recoups some of that cost because Circa charges the resident only when they do a flexible payment schedule. The company will then do a 50-50 revenue share with the property owner. For example, with a $1,000 rent the resident would pay $15 that month to do the flexible payment schedule. Of that $15, half goes back to the property.

In addition, the company offers credit reporting and takes over a property’s arrears management in a way not done by others, Hyman said.

“We have a transition in that same app that the residents are already comfortable with that is smooth and natural and goes straight from not making it at the end of the month into ‘would you pay a portion of that missed rent for the upcoming months,’” she added. “Others have people who go out and have a conversation with a resident. It is enormously labor intensive, and at a time when property managers have the highest turnover ever recorded. We take that heavy lift off their shoulders.”