Daily Crunch: European startup studio eFounders unveils its next-generation CRM tool

Hello friends and welcome to Daily Crunch, bringing you the most important startup, tech and venture capital news in a single package.

To get a roundup of TechCrunch’s biggest and most important stories delivered to your inbox every day at 3 p.m. PT, subscribe here.

Happy Star Wars Day. These are not the 4th of Mays you’re looking for. But it is a pretty awesome newsletter we’ve got for you today, so there’s that.

Extra special good news if you’re a student: Our events team put together a deal for you, with a chance to get a free ticket to Disrupt! Yeeeeeessssssss — if you’re a current student or recent graduate, book any TC Sessions student pass and you’ll automatically be eligible to participate in our student pitch competition for a chance to win a free Disrupt 2022 ticket. If you’re into clean air and water and surviving and stuff, come check out our TC Sessions: Climate Tech, for example. – Christine and Haje

The TechCrunch Top 3

- Here’s a customizable CRM. No, really, it is: eFounders went live with its Folk customer relationship management platform today. Its strategy of making it easy to customize the product for your needs aims to make you forget the name of that other really big CRM company. Its waitlist is 10,000 deep, but Romain speeds you to the head of the line with an inside look.

- Did Stripe just launch a Plaid competitor?: While that’s being debated on Twitter for now, the news is that Stripe launched Financial Connections, a product that enables its customers to connect to their customers’ bank accounts. That will, in turn, provide access to financial data to speed up or run certain kinds of transactions, essentially a faster way to get this information. However, to the point where customers have to input their bank account information when prompted, Ingrid notes “it will be interesting to see whether U.S. consumers will be happy with sharing that information in situations where it hasn’t been previously.”

- Wordle turned out to be a good buy for The New York Times: The newspaper giant reported “tens of millions” of people to the NYT site in the first quarter. Hopefully, they stuck around for some news, but we think it was just for the game.

Startups and VC

Eric Ries has contributed a lot to the startup world, being a pioneer in the Lean Startup movement, but he’s got a couple of things to answer for as well. Not least, the term minimum viable product. In his piece, Haje raves about how MVPs ain’t viable, aren’t products, and aren’t necessarily all that minimal neither. We really like this story, and Haje (who is writing this section) is a little weirded out by tooting his own vuvuzela (that’s a real instrument, not a sex joke), talking about himself in the third person singular and the first person plural in the same paragraph. Here we are, wrestling with language, doing our best.

It seems like everyone wants to crawl further upstream and invest in earlier and earlier stage companies. We’re pretty excited to see Afore capital raising a $150 million fund to start nibbling at Y Combinator’s lunch, with a brand new “standard deal” model for pre-seed investments.

Over on our subscription site TC+, Alex dug into the severity of the startup valuation nosedive in Q1.

Moar Newz:

- An untapped market: Fleksy is pivoting into offering tools to help developers create custom keyboards for their apps.

- web3 needs tax3: You may not know this, but the IRS is known for neither its sense of humor nor its cutting-edge tech. Tactic raised $2.6 million to try to help web3 folks process and account for the brave new financial world.

- This credit card is off the chain: Well, it’s kinda the opposite; it’s on the chain. Masa Finance raised $3.5 million to build out a decentralized credit protocol for the web3 era.

- I bless the supply chains down in Africa: Norebase is building a platform that will make it vastly easier for companies to start, scale and operate in African countries.

- Let’s face it: We love this story from Kyle about how, in the midst of waning interest, mask-detection companies are potentially continuing to thrive.

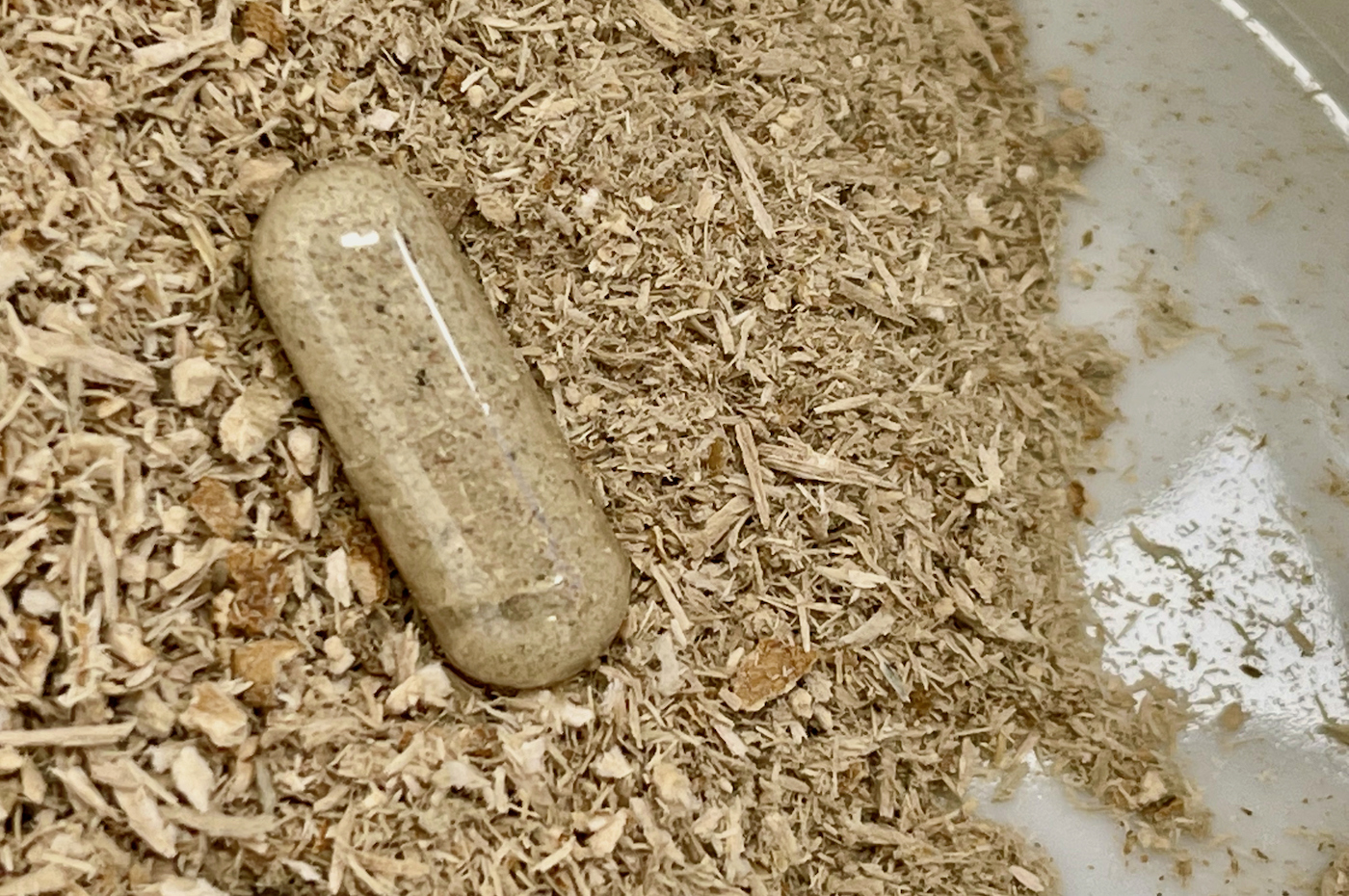

Psychedelics startups are on a long journey to consumer markets, but these 5 VCs are taking the ride

Image Credits: Leslie Lauren (opens in a new window) / Getty Images

For years, consumers have used substances like cannabis and microdoses of LSD and psilocybin mushrooms to elevate their mood and sharpen mental focus. Now that regulators and clinicians are reevaluating these drugs, investors are exploring what this mind-expanding market has to offer.

In the U.S, more than 400 clinics offer ketamine therapy, and MDMA, commonly known as ecstasy, is on track for FDA approval in 2023. In Oakland and Denver, “magic mushrooms” have already been decriminalized for adult use.

To learn more about the applications attracting VCs to psychedelics, reporter Anna Heim interviewed five who are active in the sector:

- Tim Schlidt, co-founder and partner, Palo Santo

- Ryan Zurrer, founder, Vine Ventures

- Dina Burkitbayeva, founder, PsyMed Ventures

- Clara Burtenshaw, partner, Neo Kuma Ventures

- Sa’ad Shah, managing partner, Noetic Fund

(TechCrunch+ is our membership program, which helps founders and startup teams get ahead. You can sign up here.)

Big Tech Inc.

Amazon is doubling down in India, saying today it will export locally produced Indian goods worth $20 billion by 2025, up from the $10 billion in goods it previously pledged to export.

Soon you will be able to get an NFT with your tall decaf cappuccino (if you know, you know). Starbucks is entering the world of web3 with a collection of NFTs, and we report that the idea behind it is not only to “help Starbucks better connect with younger people,” but also to “provide a way to create incremental traffic and revenue, not only in terms of retail, but also incremental revenue as a result of its own business.”

Google is rolling out some more Workspace controls for its users in Europe by the end of the year in an effort to “control, limit, and monitor transfers of data to and from the EU,” we report. It seems this is a continued effort by Google to be in better compliance with regulatory privacy laws.

Here are some other stories we think you’ll like:

- China’s tech giants are having NFT FOMO: We think that about covers it.

- In the world of vroom: Fisker revealed an all-electric luxury sports car, while car rental giant Sixt was hit with some delays following a cyberattack.

- Elon Musk may be heading to Parliament: The eccentric CEO was invited to the U.K. to speak with the Brits about his plans for Twitter.

- TikTok gets into revenue sharing: Its new ad product aims to entice advertisers with the notion of having their ad next to the top 4% of content.

- Meanwhile, Robinhood does some revenue diversifying of its own: Later this month, Robinhood is launching a stock-lending feature so that users can lend out their shares and make some recurring income from borrowers, while Robinhood will take a cut of the loans. The company kind of already does this, but what’s different here is that the earning potential is higher.