Fashinza, a B2B supply chain marketplace for fashion brands, raises $100M

The pandemic has majorly affected the global supply chain, with 60% of U.S. adults in an August 2021 Gallup survey saying that they’ve been unable to get a product they wanted in the past two months because of shortages. Bearing the brunt of the impact is the fashion industry, which employs millions of workers at […]

The pandemic has majorly affected the global supply chain, with 60% of U.S. adults in an August 2021 Gallup survey saying that they’ve been unable to get a product they wanted in the past two months because of shortages. Bearing the brunt of the impact is the fashion industry, which employs millions of workers at retail stores, suppliers, and manufacturing factories around the world. Bangladesh, one of the largest exporters of ready-made garments, saw export earnings plunge from $34.13 billion in 2018 to under $28 billion in 2020 as Western brands wrestled with pandemic-related border restrictions.

Fashinza, a Dehli, India-based supply chain “marketplace” for fashion brands and retailers, was co-founded months before the disruptions. But CEO Pawan Gupta says that the platform was designed to handle exactly these types of supply chain challenges by providing access to fulfillment options that wouldn’t normally be available to international companies.

“While exploring [the] business-to-consumer fashion ecommerce [industry], we were shocked by the serpentine supply chains,” Gupta, who co-launched Fashinza with Abhishek Sharma and Jamil Ahmad, told TechCrunch via email. “Even though brands were marking up their retail price at 75% to 80% margins, they were still making only around 8% to 10% profits and losing money due to high inventory wastage or going out of stock. [They] struggled with … opacity due to multiple middlemen and their manufacturers being thousands of miles away.”

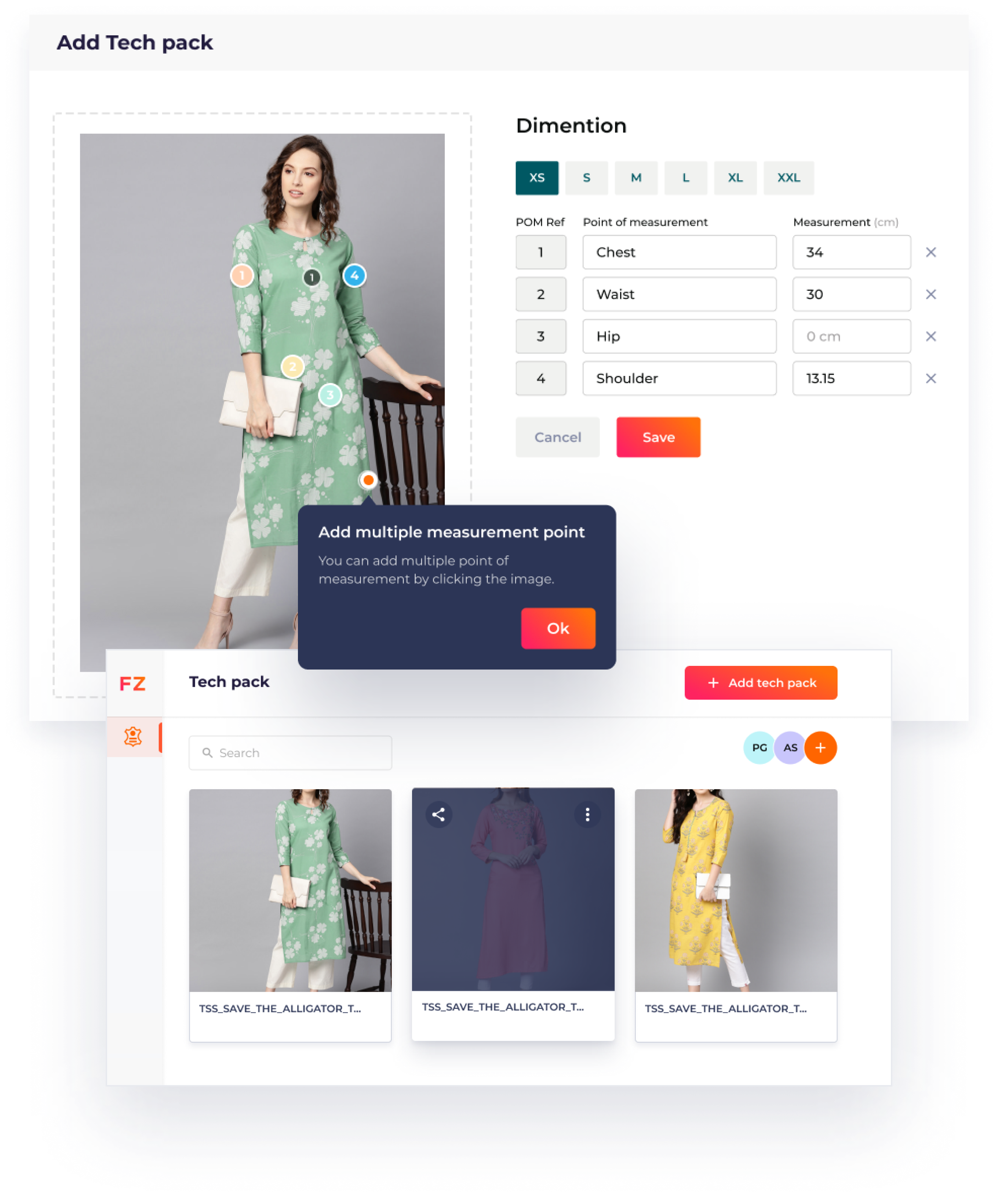

Gupta describes Fashinza’s product as “design to delivery” in the sense that it lets brands not only find manufacturers and place bulk orders, but analyze trending designs in fashion. Customers can also use Fashinza to track time and action calendars, a tool used in the apparel industry to follow up on manufacturing milestones to ensure timely delivery.

Fashinza’s B2B supply chain marketplace.

On the production side, Fashinza partners with factories to run its software stack, dubbed FactoryOS, for tasks in sampling, inventory, and finance. The software tracks the lifecycles of garments and uses the data to train algorithms for matching brands with suppliers, Gupta said, and predicting metrics like turnaround time.

In an endorsement of Fashinza’s approach to supply chain management, the company today announced that it raised $100 million in Series B funding ($60 million in equity and $40 million in debt) co-led by Prosus Ventures and Westbridge with participation from Accel, Elevation, and ADQ at a $300 billion valuation. The round brings Fashinza’s total raised to $135 million, which Gupta says is being used to refine the company’s supply chain technology and expand into new markets, including raw materials procurement.

“Business-to-business marketplaces are here to stay. We can’t imagine a world where, even in 2030, brands would need to make 100 calls, send 200 emails, and wait for six months for [a] bulk order,” Gupta said. “The entire experience is broken and doesn’t work in this fast-paced world. But the solutions … need to be vertical and very customized to … industries.”

An expanding market

Prior to starting Fashinza, Gupta co-founded Curofy, a social networking app for doctors, while Sharma previously helped to found ecommerce retailer OfferBean. Together with Ahmad, they launched Fashinza in 2020, which now employs workforce of 200 people. Gupta expects headcount to expand to 250 by the end of the year.

Fashinza makes money by charging suppliers a “usage-based” fee on every order and by providing value-added services like logistics, fintech, and business-to-business payments to both brands and manufacturers. Gupta asserts that Fashinza is able to achieve cost savings by improving the unit economics on the supply side, leveraging “unutilized capacity” and “improving production efficiency” through tech and data.

Certainly, Fashinza has no shortage of competition in a supply chain management market that Statista predicts could be worth $30.91 billion by 2026, up from $19.58 billion in 2022. Shipium gives ecommerce retailers Amazon-like supply chain tech, while ShelfLife offers a marketplace of raw material suppliers based on what brands actually need. There’s also sustainable sourcing platforms like Sourceful, which slot somewhere alongside supply chain finance platforms including Tradeshift.

Gupta argues that Fashinza’s focus on the fashion industry sufficiently differentiates it, pointing to the customer uptake so far. He claims that over 200 brands and 150 factories are currently using the platform, concentrated mostly in India, Bangladesh, China, the U.S., the U.K., the United Arab Emirates, and Vietnam.

Historically, the challenge has been convincing fashion and apparel brands to adopt technologies to modernize legacy processes, including sourcing. For example, a 2020 McKinsey study found that while 74% of brands anticipate the digitization of product development and sourcing will accelerate, only 20% plan to make technology for country and supplier selection a common practice.

But Gupta believes that Fashinza has the stuff — and the financing — to succeed. Indeed, the startup stands to benefit from the continued investment boom in the supply chain management market, which saw a $11.3 billion injection from venture firms last year.

“The solution brought about by Fashinza is essentially tech-driven, which sets us apart from our competitors. Imagine the disruptions brought about by Uber and Amazon in their respective industries. Fashinza is doing something similar in the business-to-business apparel manufacturing sector,” Gupta said. “End-to-end production can be managed through Fashinza’s platform with … transparency and control — with no need for sourcing managers to leave their offices, no need to depend on multiple middlemen, and no scope for unannounced delays.”