New bank, who dis? Lifestyle-focused neobank Cogni pivots to web3

Digital banking startup Cogni is joining the ranks of companies hopping on the crypto bandwagon. The mobile-based platform, founded in 2016 out of Barclays’ accelerator program (which is operated by Techstars), launched with the intent to offer personalized banking products suited to the lifestyles of those in the 18-to-35 crowd, CEO and founder Archie Ravishankar […]

Digital banking startup Cogni is joining the ranks of companies hopping on the crypto bandwagon. The mobile-based platform, founded in 2016 out of Barclays’ accelerator program (which is operated by Techstars), launched with the intent to offer personalized banking products suited to the lifestyles of those in the 18-to-35 crowd, CEO and founder Archie Ravishankar told TechCrunch.

Now, Cogni has raised a $23 million funding round led by Hanwha Asset Management and CaplinFO with a new mandate — bringing web2 and web3 services together on one platform, Ravishankar said. Solana Ventures, FTX Ventures, Ship Capital, Thirty Five Ventures, ROK Capital, Bluewatch Ventures, and Alsara Investment Group also participated in the fundraise.

The company last raised a $1.7 million seed round in November 2018 before it officially launched, and subsequently raised a $5 million seed extension round last year, according to Ravishankar.

“When we first started, crypto was not part of our agenda, because we really wanted to build a financial platform that suited people’s lifestyles. When crypto and blockchain became people’s lifestyle in 2021, that’s when we decided that it’s a lot more attractive to build on web3 than web2,” Ravishankar said.

Cogni founder and CEO Archie Ravishankar

The company currently offers core banking services such as deposit accounts for free to its customers through a borrowed bank charter, like many other neobanks including Chime. It also offers two lifestyle-oriented products — discounted digital gift cards to popular brands such as Adidas and Sephora that it sources through an aggregator and a feature that calculates a person’s carbon emissions based on their transactions. Ravishankar said the company serves “tens of thousands” of customers in the United States, though he declined to share a specific figure.

The first crypto-related product it plans to launch is a multi-chain wallet, which Ravishankar estimates will be released in approximately two to three months’ time. The Cogni platform will also offer its users access to an exchange to trade their cryptocurrency through a partnership; Ravishankar said it has narrowed down the contenders for this offering to two major exchanges, but did not share which ones it is considering.

He noted that the company has not yet decided if the wallet will be non-custodial, meaning users would hold and be able to access their own cryptocurrencies to transact directly. For reference, major crypto exchanges such as Coinbase offer both types of wallets, though the Coinbase default product is a custodial wallet wherein users can trade crypto based on its price movements but cannot directly access the currency they own.

After launching the wallet, Cogni plans to offer DeFi savings account on the Solana blockchain with the goal of offering higher yields than traditional savings accounts, a typical feature of DeFi products in their current state. While the company hasn’t officially chosen a partner for this product, it is considering working with its DeFi-focused strategic investor Ship Capital, according to Ravishankar.

In Ravishankar’s view, Cogni’s pivot to web3 still fits within the company’s original goal to build a bank that aims to capture discretionary spend by young consumers. Cogni will use its basic banking services as an onboarding platform for customers and then build more “social and lifestyle services” related to crypto and web3 in the long-term, he noted.

Both the neobank market and the field of web3-focused banking services are highly competitive. Cogni’s pivot to web3 is likely a bid to stand out among the ranks of digital bank competitors each offering its own interface and set of niche products tailored to specific demographics, while ultimately performing the same core functions as traditional banks.

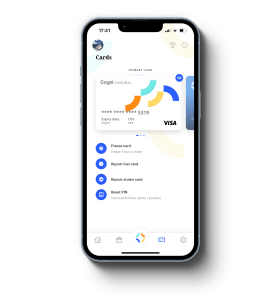

Lifestyle-focused neobank Cogni’s mobile interface Image Credits: Cogni

On the crypto side, there are plenty of independent providers of DeFi savings accounts, standalone crypto exchanges and custodial and non-custodial wallets on the market today. Ravishankar believes Cogni will be able to stand out by offering all of the above on one platform that also offers traditional banking services. He also pointed to Cogni’s user-friendly interface and focus on customer service as potential advantages in this crowded field.

Most Americans “are looking for a plug-and-play solution from the existing system into web3,” Ravishankar said. “They don’t want to download multiple applications or get to know the jargon,” he continued, explaining that a simple, easy-to-use solution is likely to be more desirable for users.

Cogni has 24 employees in New York and San Francisco today, with another eight across Europe, according to Ravishankar. The company had ~18 employees when it raised its seed round in 2018 and then downsized during the pandemic before growing again to its current size, Ravishankar said. It is focused on making new hires with a background in web3, both on the product and engineering teams, and is also beefing up its compliance team to gear up for the new product launches, he added.