On a mission to be the ‘Affirm for B2B,’ Vartana secures $57M in debt, equity

While buy now, pay later startups have largely focused on the consumer, a growing group of them are now focusing on the B2B space. The premise behind that is that after all, businesses need more flexible payment options, too. For example, in December, Affirm spinout Resolve, which specializes in “buy now, pay later” capabilities for […]

While buy now, pay later startups have largely focused on the consumer, a growing group of them are now focusing on the B2B space.

The premise behind that is that after all, businesses need more flexible payment options, too.

For example, in December, Affirm spinout Resolve, which specializes in “buy now, pay later” capabilities for B2B transactions, announced that it had raised $25 million in equity funding. Across the pond, Berlin-based Billie closed on a $100 million Series C funding round. And, in Latin America, TruePay, a one-year-old São Paulo-based “buy now, pay later” startup, recently raised $32 million in a Series A financing.

The latest BNPL startup seeking to target the B2B space to secure financing is Vartana, which aims to be the “Affirm for B2B.” For the unacquainted, Affirm — started by PayPal co-founder Max Levchin — was one of the earliest players in the consumer BNPL sector.

Founded in June 2020 by two former KeepTruckin employees, Vartana was selected as the company name because it is the Sanskrit word for “financial wellness,” according to CEO Kush Kella. And today, the startup is emerging from stealth with $7 million in equity funding and $50 million in credit.

Put simply, co-founders Kella and Ahmed Sharif say they are building a buy now, pay later and checkout platform designed strictly for business to business purchases.

“We saw the inefficiencies in the process and the time it took to complete a transaction and that helped us realize that you can digitize the entire process rather than relying on email and manual paperwork,” Kella told TechCrunch. “We want to bring the same level of flexibility Affirm has brought to consumers to businesses.”

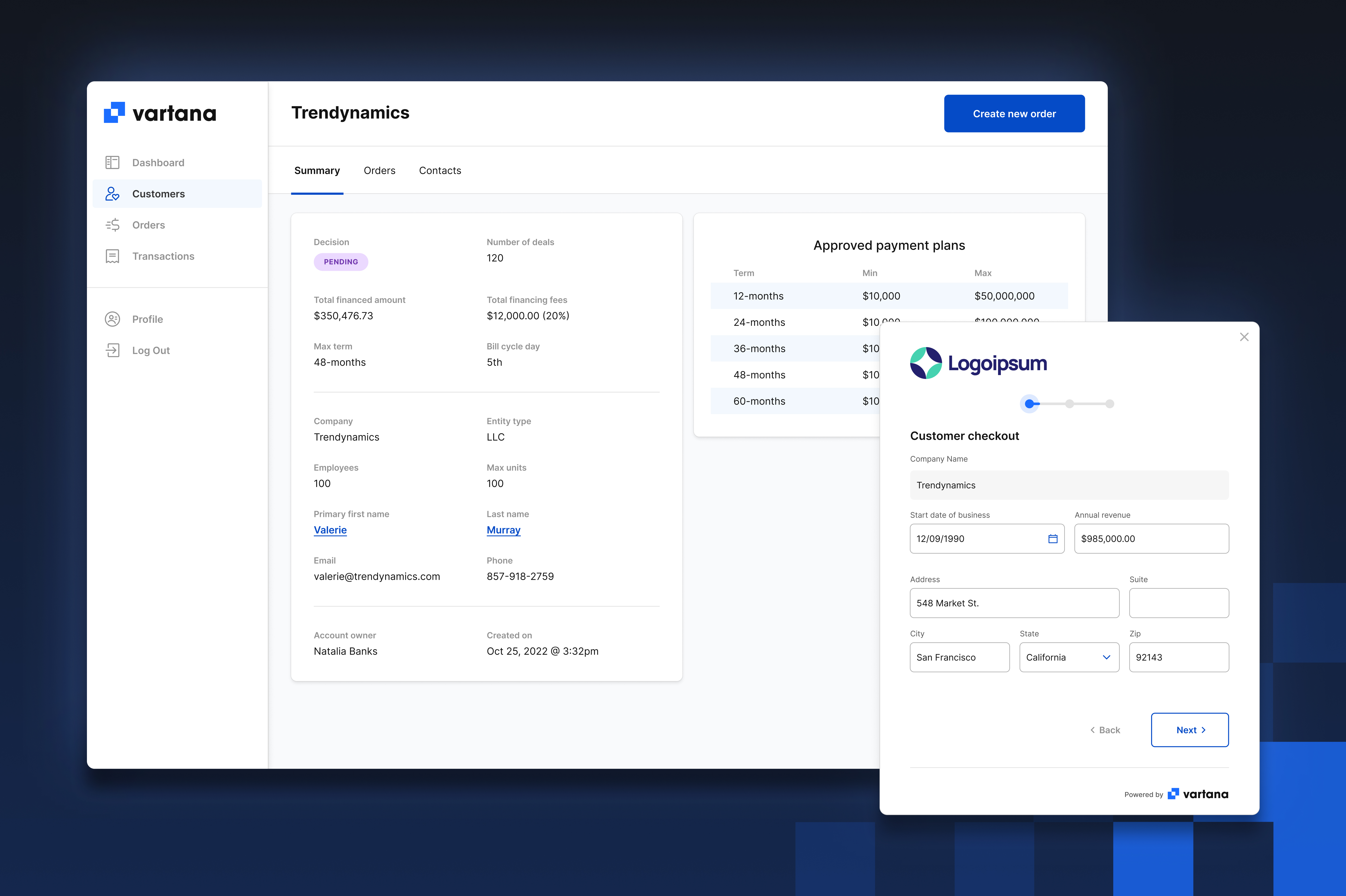

Specifically, Vartana’s target customers are mid- to late-stage technology companies and their resellers. The company was in private beta since last June and is now launching to the public after seeing transaction volume grow by 100% quarter over quarter. It works by pre-approving customers in the sales funnel for payment plans through “real-time” automated underwriting technology. Customers can then choose their preferred payment options and complete transactions “within minutes” through what the company describes as an “integrated checkout experience.”

For example, say a business is trying to purchase 50 Salesforce licenses. Typically Salesforce would want to charge that business $50,000 upfront. Some companies might not have that kind of extra cash and rather than take out a loan, they may want to spread out their payments. (Note: Salesforce is not a Vartana user.) Vartana offers terms ranging from 12 to 60 months.

“Many businesses don’t have the budget to pay for that kind of thing upfront,” Kella said.

“Our technology is focused on helping buyers and sellers collaborate and deal with more complex transactions,” Kella, who was a founding engineer at KeepTruckin, told TechCrunch. “We focus on businesses trying to acquire a technology product that could range in price from $10,000 to $1 million.”

Vartana charges a fee (a percentage depending on the length of the contract) from the seller of the tech product. In some cases, where sellers aren’t “comfortable” paying, they pass on the fee to the buyers, Kella said.

Image Credits: Vartana

Audacious Ventures led the equity portion of the financing while i80 Group provided the credit. Flex Capital and several angel investors — including KeepTruckin CEO and co-founder Shoaib Makani, Google Ventures partner and former Lime president and former Google Ventures partner Joe Kraus, Rubric CEO and co-founder and former Lightspeed Ventures Partners partner Bipul Sinha, Slack CFO Allen Shim, Rippling CFO Adil Syed and others — also participated in the funding round.

Vartana plans to use its equity funding to work on its product roadmap, which involves adding more staff to its current headcount of 17 across engineering, operations and sales.

Nakul Mandan, founder and partner at Audacious Ventures, said that every enterprise business his firm has invested in “cares about cash flow and getting paid upfront from their customers, but also benefits in sales velocity by giving better payment terms to its customers.”

Vartana, he believes, solves the problem for both the vendor and the customer “in an elegant solution, and is accordingly relevant to almost every B2B company.”

Audacious, Mandan added, was particularly impressed by the team’s vision around building an “end to end checkout solution that combines tech, customer financing and closing process management for an enterprise sales team.” The company’s closing process management and collections offering integrates within a sales reps’ existing tech stack — another differentiator in the investor’s view.

“It’s truly a holistic approach to solve what sales reps need to get their customers to quickly close deals,” he said.