TechCrunch+ roundup: Creating financial models, UiPath’s plummet, pitch deck pro tips

Did UiPath's valuation get hit by the same shrink ray affecting other software companies, or are other factors at work?

When robotic process automation company UiPath filed to go public in March 2021, the startup had just closed a $750 million round that helped it clinch a $35 billion valuation.

Although its initial IPO price range was slightly below that figure, post-debut, it bounced back to a $43 billion valuation at $90 per share.

As of this writing, however, UiPath is trading at $18.36 per share.

A year ago, “RPA was the fastest-growing area in enterprise software,” wrote Enterprise Reporter Ron Miller at the time. The sector was “growing at over 60% per year, and attracting investors and larger enterprise software vendors to the space.”

Full TechCrunch+ articles are only available to members

Use discount code TCPLUSROUNDUP to save 20% off a one- or two-year subscription

Last quarter, UiPath grew its revenue by 39%, so “the company fits neatly into the high-growth SaaS bucket,” wrote Ron and Alex Wilhelm. Even so, its valuation has plummeted to just under $10 billion.

To better understand this reversal of fortune, they looked at declining revenue multiples for SaaS companies and took a closer look at the RPA market to see whether the sector still has as much potential as many believed.

“They are the strongest company in the segment and well financed in this growing market,” said Forrester analyst Craig Le Clair.

Did UiPath’s valuation get hit by the same shrink ray affecting other software companies, or are other factors at work?

According to Ron and Alex, “the case of UiPath … is slightly hard to grok.”

Thanks very much for reading TC+ this week!

Walter Thompson

Senior Editor, TechCrunch+

@yourprotagonist

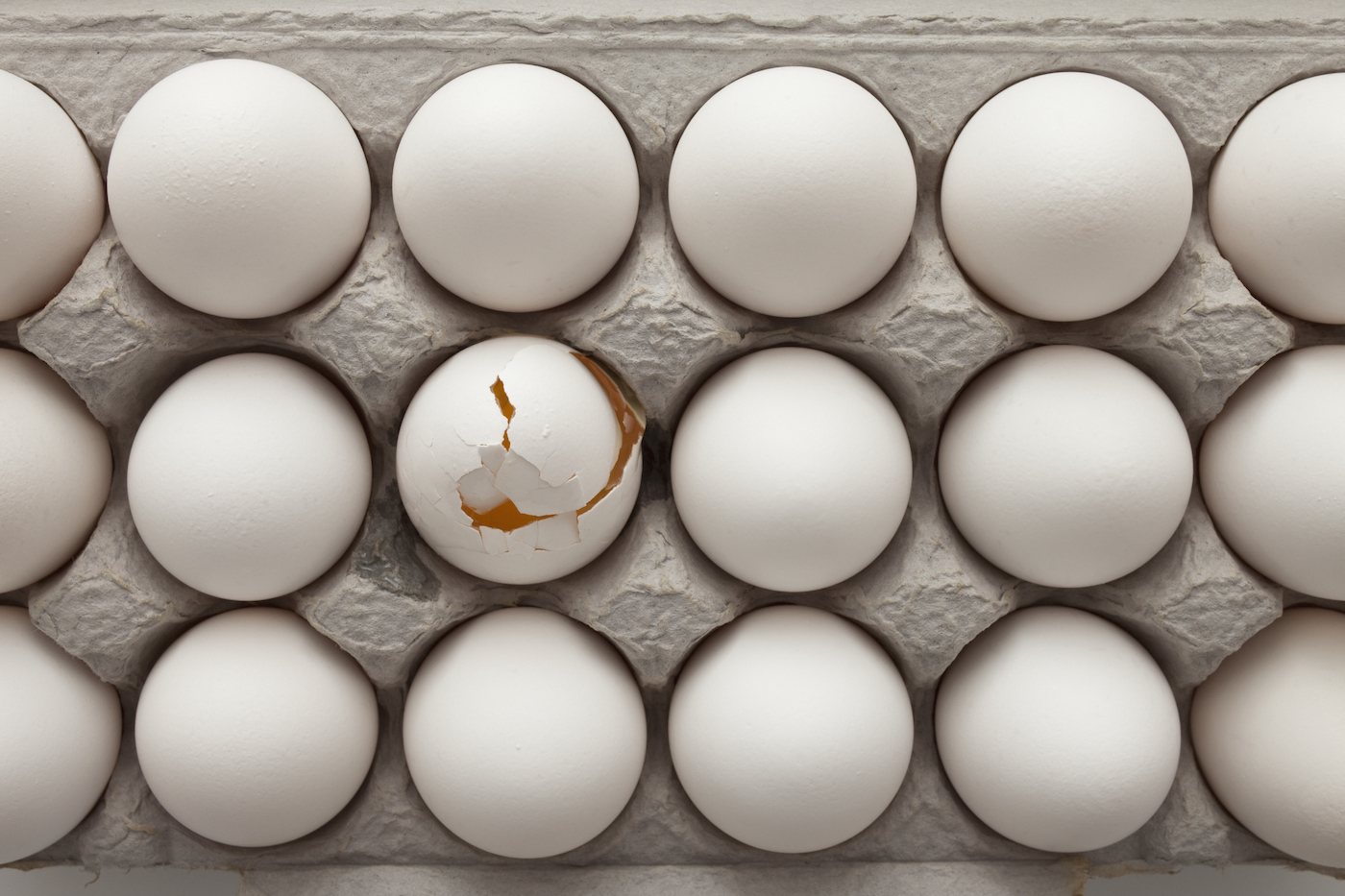

What most startup founders get wrong about financial projections

Image Credits: Mike Kemp (opens in a new window) / Getty Images

The pressures facing first-time founders are enormous. In addition to building a team and raising funds, they must also quickly become familiar with basic business operations.

The upside: Setting up and maintaining financial models isn’t difficult, and once they are are populated with data, it’s easier to stay on track when hiring, fundraising and calculating runway.

In a comprehensive TC+ article, Slidebean co-founder and CEO Jose Cayasso shows how to create spreadsheets that will help scale teams, track expenses, identify KPIs and “understand how fast your company can grow.”

Pitch deck pro tips from a leading Silicon Valley venture capitalist

Image Credits: Cavan Images (opens in a new window) / Getty Images

At TechCrunch Early Stage, Managing Editor Matt Burns hosted Lotti Siniscalco, a partner at Emergence Capital, for a session on pitch deck basics.

Between their conversation and audience questions, Siniscalco identified several basic best practices, along with potential potholes where many founders tend to twist their ankles.

“If your business requires a lot of preparation to understand the nuances before you meet the VC, you probably need to reframe your story a little bit and simplify,” she said.

“You have two minutes to make an impression, so take out the things that are not must-haves.”

H1 2022 cybersecurity product-led growth market map

Image Credits: Nataliya Romashova/EyeEm (opens in a new window) / Getty Images

To paint a detailed picture of the competitive landscape for product-led growth cybersecurity companies, investor Ross Halieliuk tracked over 800 products in a market map that includes more than 600 vendors.

His map uncovered several trends redefining PLG adoption right now in the cybersecurity industry, and some of it is bad news for early-stage startups.

In this environment, most CISOs are experiencing “vendor overload,” which means small players that lack a robust network and large marketing budgets can’t participate in the same sales channels as incumbents.

If your investors won’t approve a series of invitation-only dinners with your target clients, what are your options?

Felicis Ventures partners share the four pillars of scaling a SaaS startup

Image Credits: mingusmutter (opens in a new window) / Flickr (opens in a new window) under a CC BY-SA 2.0 (opens in a new window) license.

Felicis Ventures Partners Viviana Faga and Niki Pezeshki appeared at TechCrunch Early Stage to share advice for SaaS founders in growth mode:

- Expand outside your install base.

- Develop new products.

- Help users understand the product.

- Be 10x better.

“If you really want to take down the 800-pound gorilla, you need to make a product that is significantly better,” said Pezeshki.

“And all of the things that we’ve talked about prior to this one point kind of lead to this ’10x better’ concept.”

Here’s a full transcript of their presentation and the audience Q&A session.