Turo’s S-1 filing shows that unicorns can slingshot out of the pandemic

The Turo income statement, once we beat back some non-cash costs muddying its bottom line, has me impressed.

Peer-to-peer car-sharing company Turo filed to go public last night. TechCrunch’s first look at its S-1 filing is here, in case you missed it.

That Turo has filed to go public is not a surprise. After raising nearly $500 million while private, the company has an enormous capital base underneath it, meaning that there is also institutional pressure for the firm to pursue an IPO. Turo first raised external capital back in 2009, Crunchbase data indicates, so some investors have been waiting for the company’s S-1 filing for a long, long while.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

The good news is that Turo’s business had a turnaround year last year. After posting somewhat lackluster 2020 results, Turo saw its revenues and results rebound, at least through the third quarter. We’ll get Q4 data in a subsequent S-1 filing.

This morning, I want to compare and contrast the company’s 2020 and 2021 results as a way to show how some unicorns will come out of the pandemic with jets on. Frankly, the Turo income statement, once we beat back some non-cash costs muddying its bottom line, has me impressed.

Let’s talk about acceleration post-lockdown.

Turo’s financial rebound

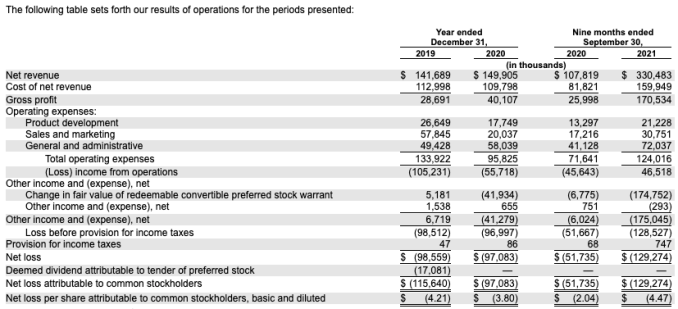

From 2019 to 2020, Turo recorded slim revenue growth. The company’s top line grew from $141.7 million to $149.9 million, or around 6%. For a venture-backed company ramping toward an IPO, that’s an incredibly thin pace of growth.

Even worse, the company’s net losses stayed essentially flat during the period, decreasing just a smidge from $98.6 million worth of negative net income in 2019 to $97.1 million in 2020.

But then, 2021 came around. Observe the differential in results:

Image Credits: Turo S-1

As you can see when we contrast the first three quarters of 2020 with the same portion of 2021, the company’s revenue growth reignited, and it swung from stinging operating losses to operating profits. It appears that last year was a rebirth of sorts for Turo — it left slow growth behind for hyper-growth (207% between 2020 and 2021, for the periods listed) and losses for profits (on an operating basis).

Yes but, I can hear you saying, the company’s net loss actually got worse in the first three quarters of 2021 when compared with the preceding year. Why are we giving it plaudits for growth when it torched so much money?