After layoffs, Flockjay lands on a new SaaS-y vision for tech sales

Months after cutting half its staff, edtech startup Flockjay has landed on a new vision for how to disrupt tech sales: start from the inside, out. The startup is building Flockjay Elevate, a platform for sales teams to use within their companies to get better at their jobs. The Elevate platform has a host of […]

Months after cutting half its staff, edtech startup Flockjay has landed on a new vision for how to disrupt tech sales: start from the inside, out. The startup is building Flockjay Elevate, a platform for sales teams to use within their companies to get better at their jobs.

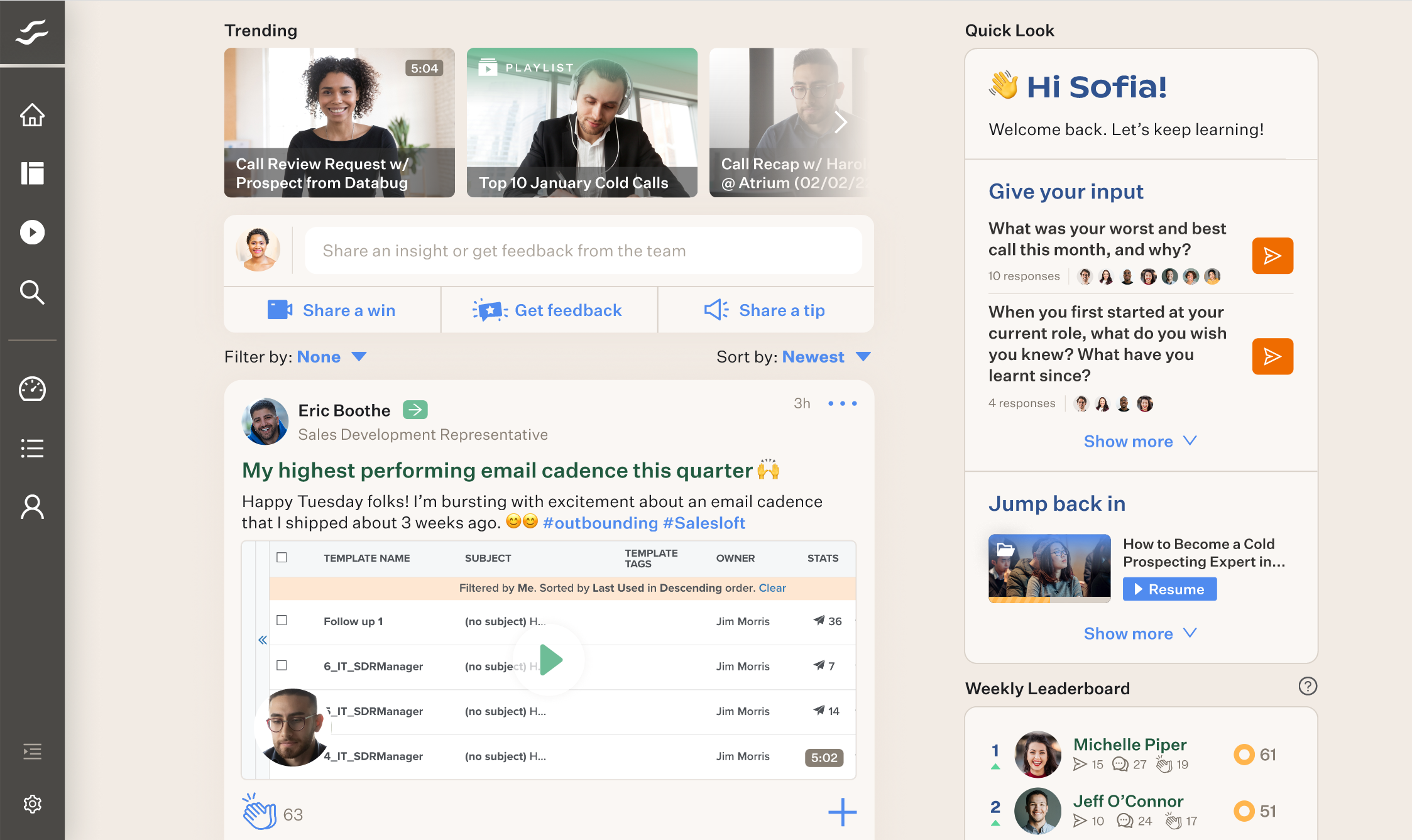

The Elevate platform has a host of different features, from a live feed that highlights wins and losses, to a library of best practices, to an analytics layer that communicates impact. It’s meant to be a spot where sales development leaders, sales managers and sales development representatives can all congregate their internal communications.

Flockjay’s new product, a B2B SaaS tool, may feel like a huge leap from where it started in the world of edtech. CEO Shaan Hathiramani thinks it’s a bet on a belief that he learned the hard way: alumni support — and keeping bootcamp graduates placed in the sales jobs they’ve broken into — is one of the biggest responsibilities tech bootcamps need to answer.

Flockjay, which graduated from Y Combinator in 2019, started as an on ramp people could use to break into tech careers. The flagship product was a 10-week sales training bootcamp that then placed graduates into sales jobs. At one point, roughly 40% of Flockjay students didn’t have a four-year college degree; half of the students identified as female or nonbinary, and half of the company’s students identified as Black or Hispanic.

The company most recently raised venture funding in an $11 million Series A in January 2021, per Crunchbase data. Eventually, Hathiramani said, the growth pace made it feel like Flockjay was “running about six or seven businesses at once.” He went on to say that the team was running an admissions and selection business, a training business, a coaching and placement business, and an alumni community, something that caused burnout among the less than 100-person team.

More problematic, perhaps, was the fact that Flockjay was not “growing at the speed that you want it too.” More specifically, Flockjay was good at setting people up for initial success, but when they got placed into a company, they weren’t thriving amid a distributed workforce. Sales roles more broadly deal with high attrition, Hathiramani added.

“We needed to hit pause and I had to make some really hard decisions about what I felt would future-proof the business, and I wanted to do it at a point in our business that wasn’t ignorant of those forces, but early.” The company’s subsequent layoffs not only came at the cost of the 30 to 45 people who lost employment, but also to the diverse customer-base that Flockjay had spent years building up.

Fast-forward; Hathiramani said that his board of directors was on board with the eventual pivot — even if it was one of the more unconventional conversations he’s had with them to date.

“If you really are serious about the mission, don’t fall in love with the solution, fall in love with the problem,” he said.

Flockjay’s new business wants to disrupt silos the team learned about when in the bootcamp world, such as low participation rates with learning modules and the lack of impact with Slack chatter, where Hathiramani says “great ideas go to die.” By making sales teams more collaborative across different mediums, he thinks he can empower those who break in to stay there longer. Put differently, he wants to centralize everyone’s strengths within a team, build best practices and create a safer, more useful space than other communications tools.

Image Credits: Flockjay

“If I’m new to an organization, whether I’m an account executive or SDR, or if I’m up for a performance improvement plan, I now have the cheat codes,” he said. “I now can tap into that and come back from them in a way that wasn’t possible.”

The competition among B2B enterprise sales tools is steep. In January, Atrium landed millions to help sales teams meet their quotas through better data analytics. After raising $16 million in Series A funding last April, Databook, an AI-powered consultative sales intelligence company, landed $50 million in Series B funding in February. Apollo.io is developing sales intelligence and engagement software for business-to-business companies.

Hathiramani asserts that customers say even Salesforce and Microsoft don’t have truly collaborative tools to help sales teams, so he’s confident that there’s enough room even in the glaringly fragmented market. The real differentiator I see, though, is a pivot that comes from a tough reality check and shifted perspective on how to build.

Join the tens of thousands of people who subscribe to my newsletter Startups Weekly. Sign up here to get it in your inbox.